Discover actionable strategies for UPVC recycling in India. Learn how manufacturers can reduce waste, meet sustainability goals, and comply with 2025 EPR regulations while boosting profitability.

Introduction: The Urgency of UPVC Recycling in India

India generates over 3.6 million metric tons of plastic waste annually, with UPVC (Unplasticized Polyvinyl Chloride) profiles from windows, doors, and pipes contributing significantly. While UPVC’s durability makes it ideal for construction, its non-biodegradable nature poses environmental challenges. With landfills overflowing and stricter Extended Producer Responsibility (EPR) laws in effect since 2025, manufacturers must adopt sustainable recycling strategies to reduce their carbon footprint and avoid penalties.

This guide explores innovative UPVC recycling methods, cost-effective technologies, and policy-compliant frameworks for Indian manufacturers aiming to align profitability with planetary health.

The State of UPVC Waste in India: Key Statistics

- Annual UPVC Waste Generation: ~280,000 tons (10% of total PVC waste).

- Recycling Rate: Only 12% of UPVC waste is recycled, vs. 30% in the EU.

- Landfill Impact: UPVC takes 450+ years to decompose, leaching toxic additives like lead and phthalates.

- EPR Compliance: Mandatory for manufacturers producing >100 tons/year (2025 Plastic Waste Management Rules).

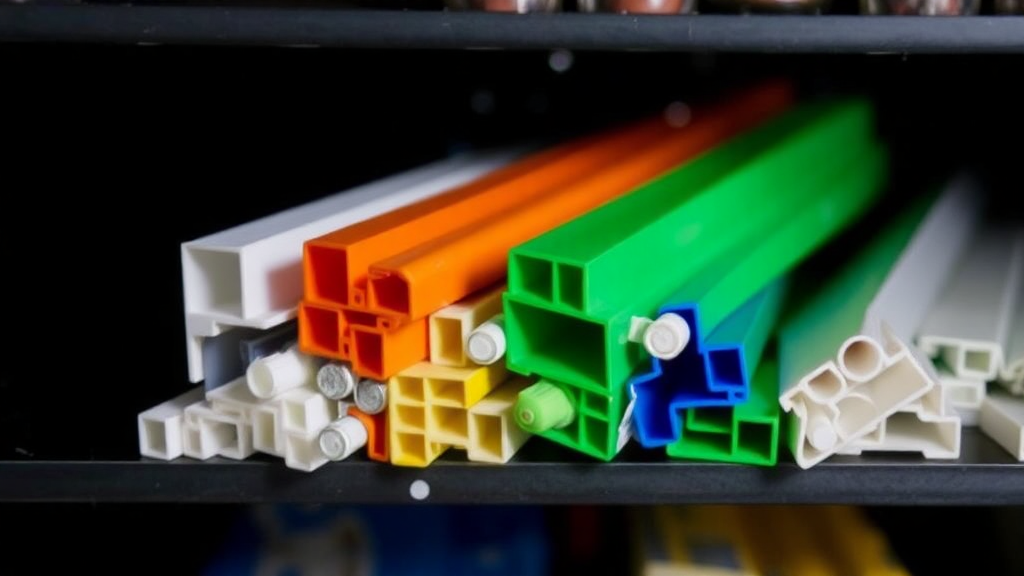

Why UPVC Recycling is Technically Challenging

Composition Complexities

- Stabilizers: Lead, calcium-zinc, or tin-based additives complicate recycling.

- Reinforcements: Fiberglass or metal inserts in UPVC profiles require separation.

- Contaminants: Paint, adhesives, and dirt reduce recyclate purity.

Market Barriers

- Low Awareness: 68% of Indian builders discard UPVC as mixed waste.

- Cost of Recycling: Mechanical recycling costs ₹18–25/kg vs. ₹5–8/kg for virgin UPVC.

- Infrastructure Gaps: Only 23 dedicated UPVC recycling plants nationwide.

Strategy 1: Mechanical Recycling – Turning Waste into Raw Material

Process Overview

- Collection & Sorting: Partner with kabadiwalas or NGOs to segregate UPVC waste.

- Shredding: Use rotary shredders to break profiles into 5–10mm flakes.

- Washing: Remove contaminants with alkaline or ultrasonic cleaners.

- Extrusion: Melt flakes at 180–220°C and pelletize for reuse.

Case Study: EcoPVC Solutions (Pune)

- Model: Installed a ₹2.5 crore mechanical recycling unit in 2023.

- Input: 500 tons/year of post-consumer UPVC waste.

- Output: 400 tons/year of recycled pellets (80% yield).

- ROI: Achieved breakeven in 18 months by selling pellets to pipe manufacturers at ₹95/kg (virgin UPVC: ₹120/kg).

Challenges to Mitigate

- Quality Degradation: Recycled UPVC loses 10–15% tensile strength. Solution: Blend with 30% virgin material.

- Energy Use: Solar-powered shredders can cut electricity costs by 40%.

Strategy 2: Chemical Recycling – Breaking Down UPVC at the Molecular Level

Advanced Techniques

- Pyrolysis: Heat UPVC at 400–600°C in oxygen-free reactors to produce HCl gas and carbon-rich char.

- HCl Recovery: Captured gas can be sold to chemical industries (₹50–70/kg).

- Char Application: Used as filler in low-cost construction materials.

- Solvolysis: Dissolve UPVC in solvents like tetrahydrofuran (THP) to separate PVC polymer from additives.

- Purity: Achieves 95% pure PVC resin.

- Cost: ₹200–300/kg (suitable for high-value applications).

Pilot Project: IIT Delhi’s UPVC Pyrolysis Initiative

- Capacity: Processes 50 kg/day of UPVC waste.

- Output: 30 kg HCl gas + 15 kg char per batch.

- Partners: Funded by MoEFCC under the Swachh Bharat Mission.

Limitations

- High Capex: Pyrolysis plants cost ₹10+ crore.

- Regulatory Hurdles: Requires PCB approvals for emissions.

Strategy 3: Design for Recycling (DfR) – Preventing Waste at the Source

Best Practices for Manufacturers

- Material Simplification: Avoid multi-layer UPVC profiles with metal/wood composites.

- Labeling: Use laser engraving instead of glued-on labels to reduce contamination.

- Additive Selection: Replace lead stabilizers with calcium-zinc alternatives (easier to recycle).

Success Story: GreenFrame Windows (Chennai)

- Initiative: Launched 100% recyclable UPVC windows in 2024.

- Features:

- Monomaterial design (no metal reinforcements).

- Water-based adhesives.

- Result: Reduced recycling costs by 35% and attracted ESG-focused builders.

Strategy 4: Collaborative Recycling Networks

Building Ecosystem Partnerships

- Producer Responsibility Organizations (PROs): Join PROs like Recykal or Saahas for EPR compliance.

- Cost: ₹3,000–5,000/ton of waste managed.

- Benefits: Audited recycling certificates and brand credibility.

- Industrial Symbiosis: Exchange UPVC waste with other industries.

- Example: Rajkot-based Shreeji Plastics supplies UPVC flakes to tile manufacturers as a sand substitute.

Government-Led Initiatives

- Plastic Parks: 10 upcoming facilities (e.g., in Assam and Tamil Nadu) offering subsidized infrastructure for recyclers.

- Tax Incentives: 50% capital subsidy for recycling tech under the Scheme for Promotion of Recycling of Plastics.

Strategy 5: Consumer Awareness & Take-Back Programs

Educating End Users

- Workshops: Partner with RWAs to explain UPVC recycling benefits.

- Digital Campaigns: Use QR codes on products linking to recycling FAQs.

Take-Back Models

- Deposit-Return Scheme: Offer ₹10–20/kg rebate for returned UPVC waste.

- Doorstep Collection: Collaborate with aggregators like The Kabadiwala for urban areas.

Case Study: UPVC ReLife (Mumbai)

- Program: Launched in 2023, collected 120 tons of UPVC waste via 50+ collection centers.

- Outcome: Diverted 85% of collected waste from landfills, generating ₹18 lakh revenue.

Policy Landscape: Navigating 2025 EPR Regulations

Key Compliance Requirements

- Waste Collection Targets: Manufacturers must recycle 30% of 2025 sales by 2027.

- Audit Reports: Submit annual recycling logs to SPCB.

- Fines: Non-compliance penalties up to ₹5 lakh/ton of unmet targets.

Tools for Compliance

- EPR Portal: Track obligations via CPCB’s online platform.

- Third-Party Auditors: Firms like TUV India certify recycling volumes.

FAQs: UPVC Recycling in India

Q1: Can recycled UPVC match virgin material quality?

Yes, when blended with 20–30% virgin resin, recycled UPVC meets IS 14812 standards for construction.

Q2: How profitable is UPVC recycling?

Margins range from 15–25%, driven by EPR credits and lower raw material costs.

Q3: Are there subsidies for recycling equipment?

Yes, MSMEs can claim 25–50% subsidies under state green manufacturing schemes.

Conclusion

UPVC recycling is no longer optional for Indian manufacturers—it’s a strategic imperative. By adopting mechanical/chemical recycling, designing for circularity, and leveraging collaborative networks, businesses can cut costs, comply with regulations, and appeal to eco-conscious buyers. Early adopters like EcoPVC Solutions and GreenFrame Windows prove that sustainability and profitability coexist.

Call to Action

- Download Guide: UPVC Recycling Compliance Checklist

- Book Consultation: Connect with our waste management experts.